With the worsening spread of the coronavirus, governments are rightly imposing ever tighter restrictions on economic activity in every European country.

The disruptions in Europe are severely affecting many service industries — especially the manufacturing sector.

Global demand for, and the supply of, manufactured goods will likely slump through the entire spring 2020 period as the pandemic-related disruptions take a toll on major parts of the global economy.

We all observe a broad-based sharp decline in economic output in April which will likely worsen in May as authorities take ever more restrictive steps to contain the spread of COVID-19.

The recovery could begin in June as the spread of the virus slows down and a surge in government spending enables health systems to cope better than before.

However, it is also possible that we will see a further spread of the virus. Severe restrictions on normal activities would then prolong the recession through the second half of 2020 before a rebound starts in early 2021.

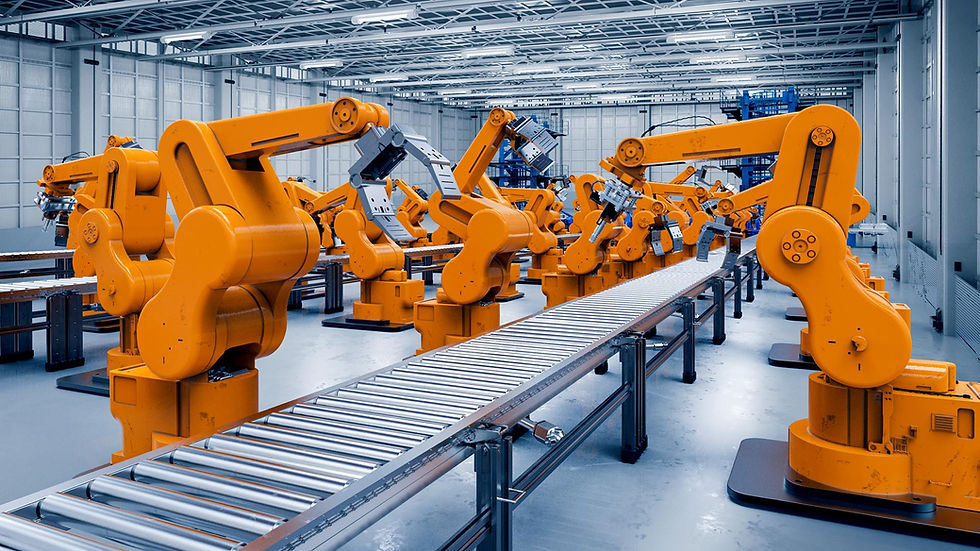

Manufacturing will be among the industries to be most negatively affected by the evolving humanitarian crisis caused by COVID-19.

How Exactly Does the Current Situation, Caused By COVID-19 Pandemics, Impact on the Manufacturing Industry?

In the context of accelerated disruption and uncertainty marked by trade wars, Brexit, the advent of 5G, regulatory pressures and digitalization, to mention just a few, COVID-19 is piling even more pressure on to manufacturers.

The most recent developments related to COVID-19 will definitely not stop digitalization. Moreover, the coronavirus crisis provides a new sense of urgency for manufacturers to strengthen their businesses through digitalization.

First, there will be an initial reaction phase, where companies will be forced to focus on short-term, actionable initiatives to cope with the first phase of the disruption. It’s very important that companies do not waste energy on initiatives that will take too much time to execute.

It’s highly likely in fact that the industry will have a bumpy ride for the next four or five months (under the optimistic scenario) and up to 10 months (pessimistic scenario).

In this latter scenario, the pandemic is expected to heavily disrupt both the demand behavior as well as the supply and capability of companies to deliver goods to the market.

This will require a completely new set of skills centered around having higher operational agility and leveraging real-time demand intelligence and process visibility.

In the words of Eric Schweitzer, president of the Association of German Chambers of Industry and Commerce, “industry is in need of unconventional and immediate actions.”

Fourth Industrial Revolution and The Manufacturing Industry

History of Industrial Revolutions

Most manufacturing lines still look a lot the same way they did 10, 20 or even 30 years ago. Operators clock in, have a brief conversation with their crew and shift supervisor, and then operate a machine or tool for 8–12 hours before heading home.

Depending on the day, the machine may break and need maintenance or an adjustment, the line settings may need to be modified for a specific product or run, or the operator may need to step away to resupply the line or be trained on a new procedure.

Factories across continents are undergoing a transformation with the rise of Industry 4.0. New technological possibilities and data opportunities are laying the groundwork for reimagining nearly every aspect of traditional manufacturing — from production lines to the factory floor and supply chains.

The result is a Smart Factory with connected equipment, machines, systems and personnel designed to drive business value.

What is Smart Factory?

In the announcement of its report, entitled ‘Smart Factories @ Scale‘, Capgemini defines a smart factory as follows:

Smart Factory leverages digital platforms and technologies to gain significant improvements in productivity, quality, flexibility, and service.

In other words, Smart Factory deploys Smart Manufacturing technologies for Industry 4.0. Physical machines are fitted with smart sensors and are connected to a cloud network where it uses data from connected operations and production systems to learn and adapt to spontaneous situations and make real-time decisions.

Of course, there are more Smart Factory definitions out there. Most of them point to the digitized and connected aspect of the factory and the Smart Factory as an evolving given in smart manufacturing and Industry 4.0, along with a list of additional capabilities and technologies including the ones mentioned and other usual suspects such as artificial intelligence and machine learning (a bit everywhere throughout the systems and the data and automation/decision and predictive aspects), Big Data analytics, advanced robotics, digital twins and simulation, additive manufacturing, etc.

Schneider Electric, mentioned in the announcement of the report with a quote from Mourad Tamoud who is, EVP, Global Supply Chain Operations at the company, defines a Smart Factory as follows:

Leaping forward from traditional machine automation, the Smart Factory deploys Smart Manufacturing technologies for Industry 4.0.

Physical machines are fitted with Smart Sensors and are connected to a Cloud network where it uses data from Connected Operations and Production Systems to learn and adapt to spontaneous situations and make real-time decisions.

Smart Factory

Future of Manufacturing Industry

As technology continues to advance exponentially, barriers to entry, commercialization, and learning are eroding. New market entrants with access to new tools can operate at a much smaller scale, enabling them to create offerings once the sole province of major incumbents. While large-scale production will always dominate some segments of the value chain, innovative manufacturing models — distributed small-scale local manufacturing, loosely coupled manufacturing ecosystems, and agile manufacturing — are arising to take advantage of these new opportunities.

Four Key Shifts in Manufacturing

Meanwhile, the boundary separating product makers from product sellers is increasingly permeable. Manufacturers are feeling the pressure — and gaining the ability — to increase both speed to market and customer engagement.

And numerous factors are leading manufacturers to build to order rather than building to stock. In this environment, intermediaries that create value by holding inventory are becoming less and less necessary.

Together, these shifts have made it more difficult to create value in traditional ways. At the same time, as products become fewer objects of value in their own right and more the means for accessing information and experiences, creating and capturing value has moved from delivering physical objects to enabling that access.

These trends can affect different manufacturing sectors at different rates. To determine the speed and intensity of the coming shifts in a particular sector, companies should consider factors including the extent of regulation, product size and complexity, and the sector’s level of digitization.

As these trends play out in a growing number of manufacturing sectors, large incumbents should focus more tightly on roles likely to lead to concentration and consolidation, while avoiding those prone to fragmentation.

The good news is that three roles driven by significant economies of scale and scope — infrastructure providers, aggregation platforms, and agent businesses — offer incumbents a solid foundation for growth and profitability.

Due to competitive pressures, large manufacturers may experience increasing pressure to focus on just one role, shedding aspects of the business that might distract from the company becoming world-class in its chosen role. The likely result is a significant restructuring of existing product manufacturers.

The growth potential of adopting a scale-and-scope role can be further enhanced by pursuing leveraged growth strategies. Rather than focusing solely on “make vs. buy” options, large players will have an opportunity to connect with, and mobilize, a growing array of new entrants, many of which will target fragmenting portions of the manufacturing value chain in order to deliver more value to their customers.

Two emerging business models, “product to platform” and “ownership to access,” seem particularly promising in terms of driving leveraged growth strategies.

B-AIM